Mobile Data Costs Slowing Digital Adoption in Africa

Why bother with these apps? I have never understood! They take so much data!

Why bother with these apps? I have never understood! They take so much data!

Many African startups can relate to the struggle of convincing people that using their solution is more effective than picking up a phone or using pen and paper. The acquisition of customers on digital solutions often comes with costs associated with educating the market, establishing offline customer touchpoints and subsidizing products in order to attract reluctant adopters. This greatly challenges the expectation that tech startups usually design products that can rapidly serve large markets while enjoying economies of scale. The digital adoption lag in Africa makes it more difficult for startups to reduce the cost of serving additional customers as they expand. For African startups, growth is often coupled with more operational friction and the ability to fully leverage on the efficiencies of technology is limited.

As someone who is immersed in the tech world, I am often reminded of the realities of the digital divide especially when interacting with tech solutions for everyday use. For instance, I prefer to use my telco app as opposed to the SIM toolkit when I want to buy airtime and access mobile money services. The steps required to make a transaction are less, I can easily access my contacts when sending money and reduce the errors I make before completing a transaction. I remember once attempting to make a payment using my app at a supermarket. I must have run out of bundles because I was unable to initiate any transaction. It took me a while to figure this out and so I struggled with my phone before finally deciding to use the SIM toolkit. The pressure to complete the transaction is usually so high in this kind of situation. I felt even more pressured when some behind me honestly asked:

“Why bother with these apps? I have never understood! They take so much data, every time they want you to download a new one and they eat up storage. Now look these ma-apps are leaving you stranded! ”

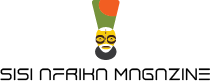

I could see the rest of the queue almost nodding in agreement and I wasn’t in opposition. Data in Africa is very expensive- accounting for 18-60% of minimum wages.

How much does 1GB of data cost?

Source: Up Next What Does 1GB of Mobile Data Cost in Every Country?

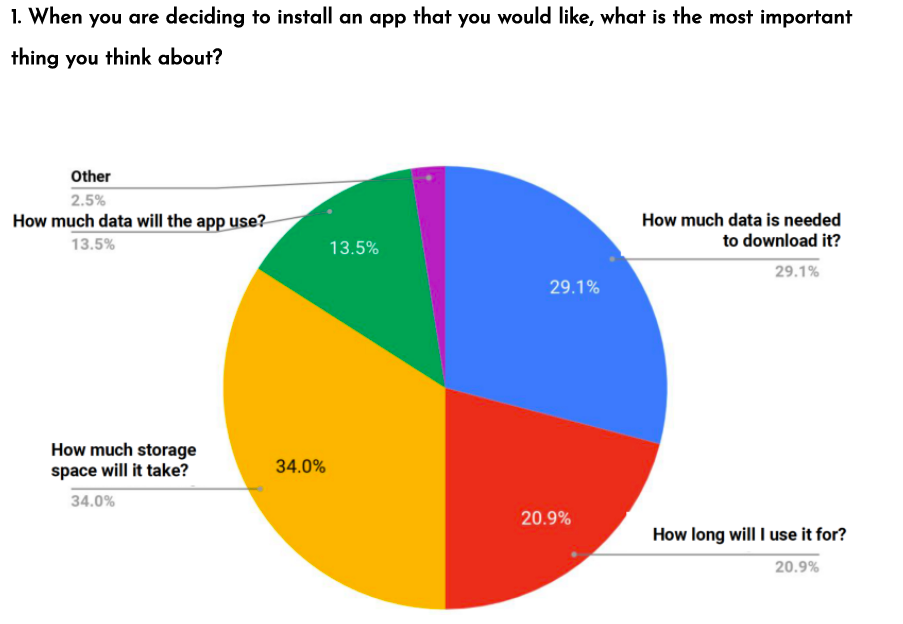

Besides the reality of low internet and smartphone penetration, African startups also ought to be sensitive to the fact that their consumers factor in the cost of data when deciding to interact with their products. Users are concerned that apps consume data when in background mode and that more data is required to download upgraded versions of the app. Additionally, there is an issue of having limited storage capacity, considering that most people use low-cost mobile devices.

What’s important to a consumer when they download an app?

Source: The biggest challenge every app startup in Africa has, but doesn’t know

The Considerations

When considering the cost of data and space, web app and SMS based solutions seem to appeal to customers. The ease of web browsing/ SMSing also often exceeds the perceived convenience that comes with installing a mobile app. Either way though, customers are more receptive when there is little to no cost associated with accessing a digital solution. An early-stage startup that wants to drive the adoption of their solution would therefore need to prioritize the development of cost-effective channels such as USSD, SMS or light web-based apps. In the case that a full functioning mobile app is crucial for a complete experience, it is important to ensure that the app is very light and cost-effective. Product teams in this context would also need to highly weigh in client annoyance when testing any changes and new features. The popular “ship code faster” motto ought to be implemented with “a pinch of salt” within an African context. Applying a reiterative experimental approach without carefully considering consumers’ sensitivity to changes may negatively affect efforts to on-board customers.

Even after we account for the cost barriers to digital adoption, customers can still be very hesitant to use a tech-enabled solution. There is a low level of trust for fully digital solutions as customers still feel that they need human-interaction/relationships to establish trust. Banks and telcos have already faced this reality when trying to drive the adoption of mobile banking. For instance, the adoption of digital banking channels was largely driven by agents who would serve as customer offline touch-points. Old habits die hard! African startups are not exempted from this behavioral resistance. There is pressure to ensure that interaction with a tech product leads to trust, especially on first try. This can be facilitated by having offline touchpoints such as agents or providing additional support during the on-boarding process. Nevertheless, digital on-boarding remains a priority as offline channels are difficult to track and scale. In this case, explicit economic incentives have the potential to drive digital adoption (e.g. promotions, raffles, cashbacks). Messaging around cost-saving and value addition then becomes crucial when trying to penetrate price-sensitive markets across the continent.

Conclusion

Having considered economic and behavioral barriers to digital adoption, startups still face the challenge of finding product-market fit within their respective sectors. Coordinated efforts to push for digital adoption would hence support the tech ecosystem seeing that consumers can benefit from the network effects of digital platforms, allowing for a multiplier effect on adoption. With this in mind, it may be worthwhile for early-stage startups to coordinate the development and messaging of simple, accessible and affordable digital solutions.