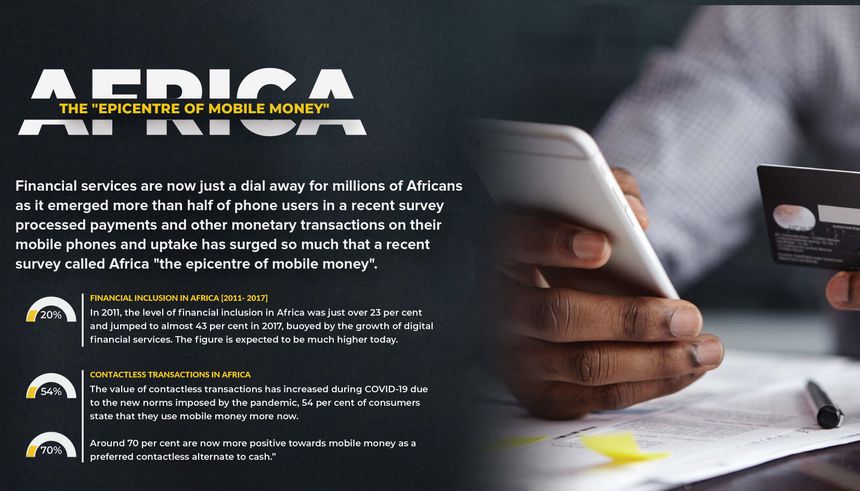

Africa, the “Epicentre of Mobile Money”

Financial services are now just a dial away for millions of Africans as it emerged more than half of phone users in a recent survey processed payments and other monetary transactions on their mobile phones and uptake has surged so much that a recent survey called Africa "the epicentre of mobile money".