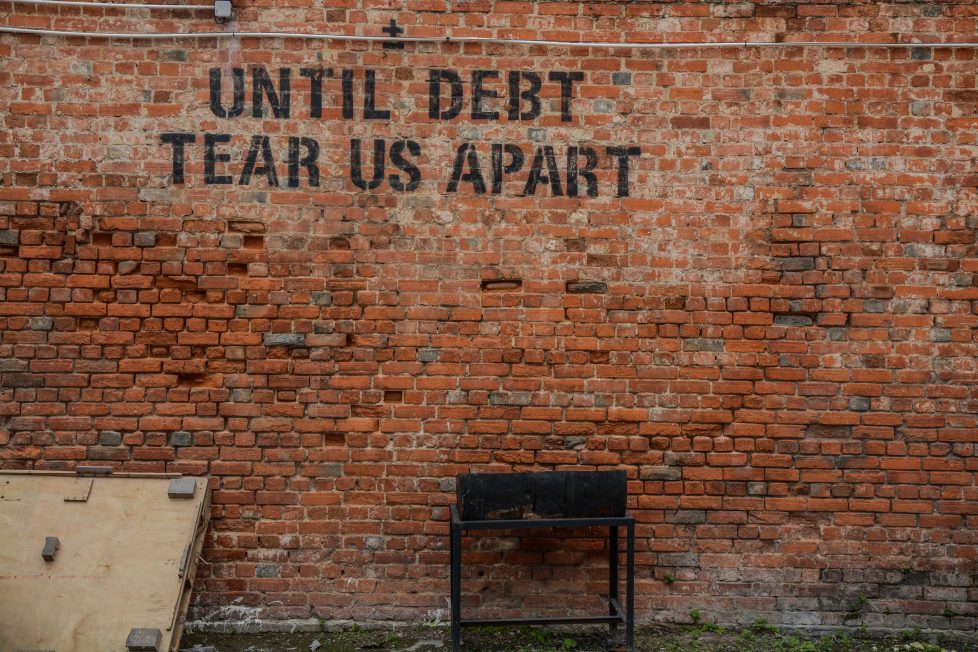

Debt Cancellation Can Alleviate the Unending Cycle of Debt Distress and Crises in Sub-Saharan Africa

The inability to make timely debt service repayments, due a myriad of internal and external factors, including COVID-19 and the Russia-Ukraine crisis, have increased concerns about an impending debt crisis in Africa. Debt suspension and debt relief are laudable initiatives, but a radical step towards debt cancellation can free the world’s poorest countries from the unending cycle of unsustainable debt-service payments, abject poverty, and underdevelopment.